Virtual Data Rooms for Initial Public Offerings

The growing IPO market requires virtual data rooms (VDRs) for safety, efficiency, and cost-effectiveness. Modern virtual data rooms (VDRs) have revolutionised the way companies manage and share confidential documents during an IPO. VDRs empower IPO stakeholders and external parties with secure, centralized, and highly efficient solutions.

Here, we’ll explore how VDRs streamline the entire IPO journey. Trade secrets vary from initial IPO preparation to successful listing:

- Why are virtual data rooms crucial for investment banking and IPOs?

- How do investment bankers use VDRs during an IPO?

You’ll learn how VDRs enhance efficient collaboration and strategic partnerships, protect sensitive corporate data, and accelerate your path to IPO.

What is an IPO?

A private firm provides stock to public investors in an initial public offering (IPO), after which the company’s stock debuts on the exchange. Initial public offerings (IPOS) are multifaceted events that require extensive data processing. IPO interaction among multiple stakeholders and external advisors requires financial audits and due diligence. That’s when VDRs are critical for safeguarding the process.

What is a data room for IPO?

A virtual data room for initial public offerings (IPOs) enhances business operations for investment bankers. Preparing for an IPO, VDRs ensure security, efficiency, and cost-effectiveness.

Benefits of a virtual data room for IPOs

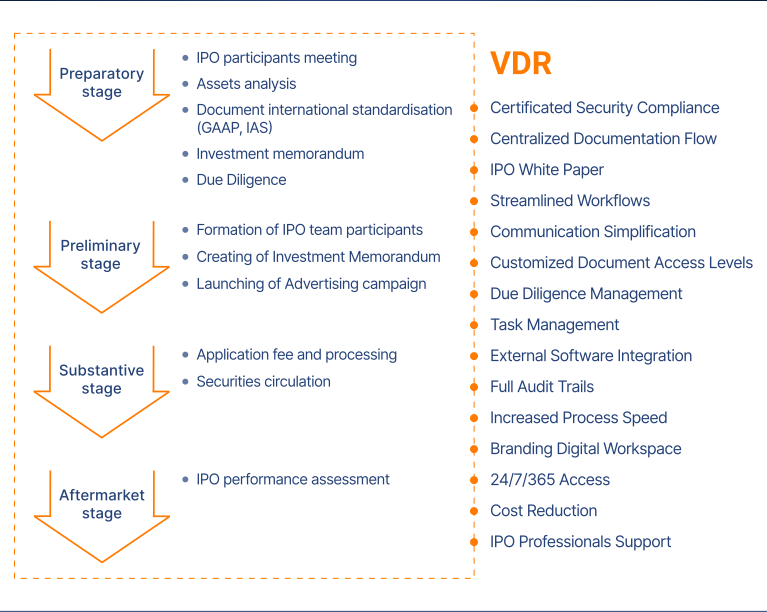

The outlined benefits highlight how users leverage the virtual data room functionalities with maximum effectiveness during the IPO process:

| Benefit | Description |

| Compliance with security standards | Unlike traditional physical data rooms, VDRs are trusted in the business world and comply with international security standards, industry best practices, and certifications: SOC 1, SOC 2, HIPAA, GDPR, and ISO 27001. Compliance warrants that the VDR provider secures data confidentiality and sensitive documents within the data room. |

| Smooth document arrangement | All the files and documents are securely stored in one place and are managed in the dashboard. Virtual data room features like indexing allow unlimited users to find the files they need. |

| Creating IPO white papers | You do not need to develop a separate IPO template for every new project. Top data room providers customise IPO white papers to your objectives, goals, and standards. |

| Enhanced communication | While all of the IPO information is located in a single data room, there is no need to use other communication tools. There is a question-and-answer section available on VDRs, where you may pose enquiries. You may also track the history of changes in the documents. |

| Granular document permissions | VDR permission features enable data sharing and restrict access to certain parts of the shared documents. There are view-only options as well as other viewing restrictions to prevent data leakage. Secure sharing entails that shared documents are watermarked to prevent unlawful copying and dissemination. |

| Due diligence management | The IPO due diligence process requires managing a significant number of documents. Data management features ensure a secure space for secure file sharing. Security features (access levels) help to control user permissions to view confidential information. |

| Integration with other tools | IPO VDRs allow for integrations with other tools like Google Drive to grasp all of the needed files seamlessly. |

| Routine optimization | IPO online data rooms allow for assigning documents to multiple team members and stakeholders. Everything is monitored and managed through the intuitive dashboard, so you can track the progress to eliminate duplications. |

| Audit trails | IPO data rooms provide monitoring and insightful analytics capabilities to track data room activity and record engagement. You can track investor interest in certain files and which documents they are checking the most. Tracking features allow for efficient planning of the IPO due diligence strategy. |

| Time-saving | IPO VDRs save precious time and speed the IPO process. The IPO process is about active communication among public companies, bankers, auditors, and other interested parties involved. The ability to manage everything in one place saves time and effort. |

| Customized workspace | The VDR providers for IPO purposes allow you to customize your working space in line with the project’s purposes and transaction objectives. |

| Unlimited document access | IPO virtual data rooms allow 24/7 access, meaning you can manage projects that involve international shareholders and clients. You can access the documents anytime on any device with data room access. |

| Cost-effectiveness | IPO VDR providers provide diverse pricing models to fit your requirements. Monthly plans vary depending on the number of projects, storage capacity, and other features. |

| Professional support | Professional support will structure your IPO data room in line with your strategic goals and IPO needs. |

The initial public offering process

An initial public offering (IPO) arises when a firm decides to ‘go public’ and find funding for the growth of its operations. IPOs enable companies to raise awareness about their brand and attract prospective investors.

The IPO process is a time-consuming challenge. It may take up to a year to prepare all of the needed documentation and extra time needed for marketing purposes.

We’ll now explain the four parts of the IPO process:

1. Preliminary IPO stage

At the beginning of the IPO process, it’s important to analyze the financial and economic situation and organisational and asset structure, as well as other business transactions.

The preliminary stage begins before stock shares are offered to the public on a stock exchange.

Here is what the company should complete during the preliminary IPO stage:

- Meeting with all participants in the IPO process. All members of the working group involved in the IPO meet and discuss the processes. The meeting participants include owners, project management teams, top company managers, independent auditors, investment bankers, and underwriters, as well as legal advisers and representatives of underwriters.

- Analyzing the company’s assets. The preliminary analysis of the company’s financial condition (complex financial transactions) and asset structure helps to determine the current level of corporate governance quality, target parameters of the structure, cost of capital, and transparency of the company’s financial statements.

- Making documents compliant with international accounting standardisation. Compiling financial documents that follow international standards, including GAAP and IAS.

- Initiating a due diligence process. Conducting due diligence is the most time-consuming aspect of the initial public offering process. A significant amount of documentation is required for the operation, and both the underwriters and the corporation are responsible for filling it.

Carry out a thorough investigation into all of the commercial enterprises’ financial operations. The company offering the securities needs to register with the Securities and Exchange Commission (SEC) and execute the obligatory contracts between the organisation and the underwriter.

2. Preparatory IPO stage

Positive preliminary stage outcomes let the company prepare for the IPO.

Changes to the firm’s core business operations and views, such as corporate governance, staff, working capital, and so on, often take place during the preparation stage. The target company may make new appointments and change its corporate systems and arrangements.

The following stages constitute the IPO readiness phase:

- IPO team. The development of an initial public offering (IPO) implementation and configuration strategy is assigned to a group of players in the IPO process. Advisors are often appointed by the firm to determine the market value of the company as well as the cash that has been raised.

- The memorandum of investment. In this document, sensitive information that assists investors in making informed choices is included. This information includes the strategy for the use of funds, the dividend policy, the method for establishing the price per share, and the determination of the number of shares to issue.

- Advertising campaign. IPO prospectuses are marketing papers. Investors need everything in this file. Ad campaign excellence determines investor attraction. Organising promotions and determining user access levels are both made easier with the aid of the virtual data room. The main task of the ad campaign is to create hype over a soon-to-be public company to boost the share price of the IPO.

3. The IPO

At this step, securities purchase applications are collected. Company shares are priced using online and shared data.

The marketing phase of an IPO seeks market value. Due to transparency restrictions, financial planners do not disclose this information.

The issuing company receives funds at the “offer price.”

4. The final IPO stage

Securities circulation and market competitiveness conclude the IPO.

After the IPO, a 25-day transition begins. Underwriters evaluate the target company’s value and profits when it expires.

During the last stage of the initial public offering (IPO), the company reviews the performance of the IPO, develops a strategy, and implements agreements. The process can be challenging and time-consuming. Lawyers and investment bankers should check documents.

VDR services are safe and efficient for collaboration to secure cloud storage environments for shared files.

Important features of a Virtual Data Room for IPO

| Feature | Description |

| Certified security compliance | Ideals complies with international data security certification standards. The VDR provider ensures the confidentiality of private data. |

| Centralized documentation flow | Datasite ensures that every piece of required paperwork is found on a single digital platform. |

| Streamlined workflows | Ansarada is a fully customized IPO VDR platform with automated work processes. |

| Smooth communication | Dealroom excludes email or other communication software. The vendor offers enhanced question and answer tools that allow users to discuss all of the documentation and trace the history of questions asked. |

| Document access permissions | Intralinks provides a flexible document management platform for IPO purposes. The administrator sets file access levels. It is also possible to establish working groups that have access to documents. |

| Due diligence management | Imprima ensures the safety of the sell-side due diligence process for initial public offerings. |

| Audit trails | SecureDocs tracks and analyzes user activity. Individual reports provide help to monitor interest expressed by potential investors and plan the IPO due diligence strategy. |

Choosing the IPO data room

While selecting a proper VDR for IPO purposes, make sure virtual data rooms provide financial and legal data protection:

- 256-bit AES encryption

- Two-factor authentication

- Multi-factor authentication (MFA)

- Granular access permissions

- Full audit trails

- Dynamic watermarking.

Underwriters, legal teams, and investors need a user-friendly interface to minimize training time and speed up due diligence. Make sure your VDR provider delivers:

- Drag-and-drop uploads

- Bulk upload operations

- Full-text search.

Also, check your chosen software for initial public offerings for:

- IPO track record

- ISO 27001 and SOC 2 compliance

- 24/7 customer support.

Match virtual data room costs to your budget and data/user demands to ensure scalability without hidden expenses. Opt for free trial and free demo versions to choose the best data room vendor.

Conclusion

Virtual data rooms for IPOs protect sensitive information and empower businesses by delivering unparalleled security and enhancing efficiency throughout the due diligence process.

Secure and efficient virtual deal rooms save costs, centralize essential data, and facilitate seamless collaboration features among IPO stakeholders.

The right choice among IPO virtual data room providers will accelerate your journey to a successful public listing with data integrity and stakeholder confidence.